Award-winning PDF software

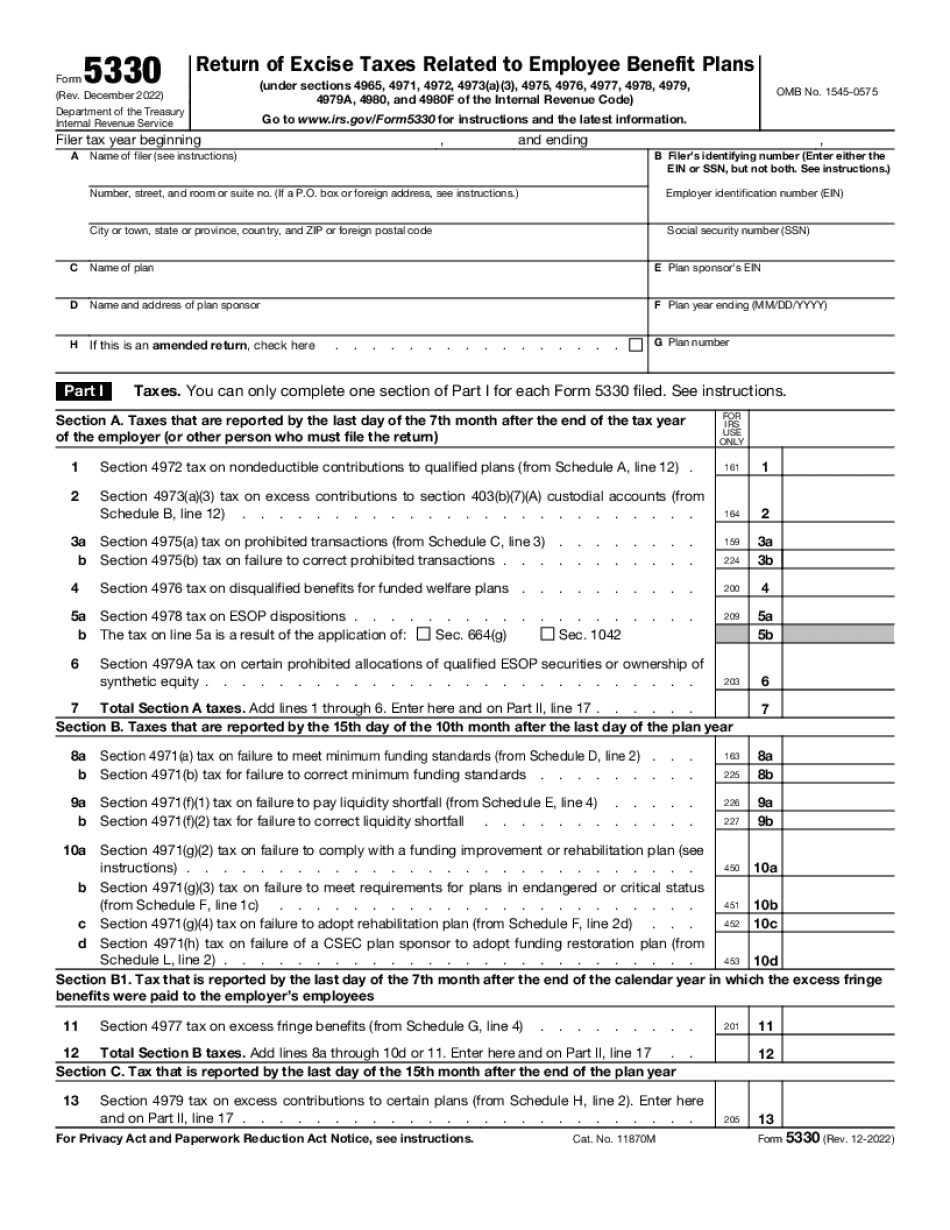

Form 5330 West Valley City Utah: What You Should Know

Federation of Tax Administrators Model FFP Application Form (PDF) and U.S. Department of Labor Voluntary Fiduciary Correction Program (FCP) Application Form (PDF). Taxation and Social Security Administration, Voluntary Fiduciary Correction Program (FCP) (updated July 2010) (PDF) U.S. Department of Labor Voluntary Fiduciary Correction Program (FCP) — The Guide to FFP Application Form Development (PDF) If you have questions about the application for a voluntary fiduciary correction program, contact the Secretary of Health and Human Services. In most cases of voluntary fiduciary fraud, taxpayers who have lost their eligibility claim will receive an additional notice asking them to contact the IRS or a related tax authority with any additional questions. If the taxpayer has not received any additional notices, a taxpayer may be able to correct their information while still in the IRS's database. For taxpayers who have been audited by the IRS, there are four options for correcting and correcting their information. Option 1: Update the information on their original tax return. Option 2: File a corrected IRS Form 886-EZ with the correct information. Option 3: Use Form 5344 to change their name on their corrected return. Option 4: Add a penalty for a penalty-shifting violation. Step 1: Make sure all information and fillings appear on their original return. When you begin your file review, make sure you make sure that all information and fillings on your original return appear on that original return. Step 2: Use the Corrected Form 886-EZ To Correct Your Returns. The corrected Form 886-EZ will show you the correct information you need to fix. This form works on most returns and is one of the most commonly used tools in the IRS program to correct erroneous information in an application for FD CPA correction or removal of name fraud. Step 3: Add a penalty for a penalty-shifting violation. Use the penalty-reducing Form 5344 to fix your income tax and SSI return. Use the penalty-reducing Form 5344 to fix your employment tax and SSI return. Step 4: Use the Free App The IRS has designed the application to help taxpayers in correcting the information on their file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5330 West Valley City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5330 West Valley City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5330 West Valley City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5330 West Valley City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.