Award-winning PDF software

Form 5330 online Arvada Colorado: What You Should Know

Enter the Sales Tax Rate For many years, we've written about the fact that many counties and municipalities in the state of Colorado do not charge a tax on the sale of certain items like food and tobacco to consumers. Unfortunately, this hasn't always been the case. Under current state law, a variety of items such as cigarettes, beer, wine, spirits, candy, pet food, tobacco, and tobacco products are excluded from the Colorado State Excise tax. However, the list of exemptions varies by county and municipalities. However, you don't need to be an expert tax attorney to understand the complicated, detailed process of filing Colorado sales tax return online. However, if you were to take the time to review the information, you may begin to understand the confusion and potential problems that consumers have with Colorado's sales tax rate system. You should always check sales tax rates for specific counties and/or cities before making purchases. Some counties, cities, and towns require that you show a valid Colorado sales tax license when you make a purchase. Most municipalities and counties collect sales taxes from out-of-state-based manufacturers, distributors, and retailers of Colorado products, but they may not add sales taxes to out-of-state-bound sales made from within Colorado. Many out-of-state-based retailers cannot and will not sell products to consumers if they do not have Colorado license. So, if you do purchase certain products, make sure to check these situations before you purchase: • Are the product(s) that you are purchasing taxable, and will tax be added or withheld? If so, then you are not purchasing products from within Colorado. • Can you use the tax credit? Before you purchase any of these products, look for additional information on tax rates and sales tax exemptions that can help you calculate Colorado tax liability. The following information should give you an idea of what to expect when determining if that particular sale qualifies for Colorado sales tax exemption and tax refund. Sales Tax Exemption and Refund Information • If the sale does not qualify for a sales tax exemption, then the seller's cost of the products used in the sale will be withheld by the county collector. You may use the credit for sales tax paid in other states when making a Colorado purchase from out of state.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5330 online Arvada Colorado, keep away from glitches and furnish it inside a timely method:

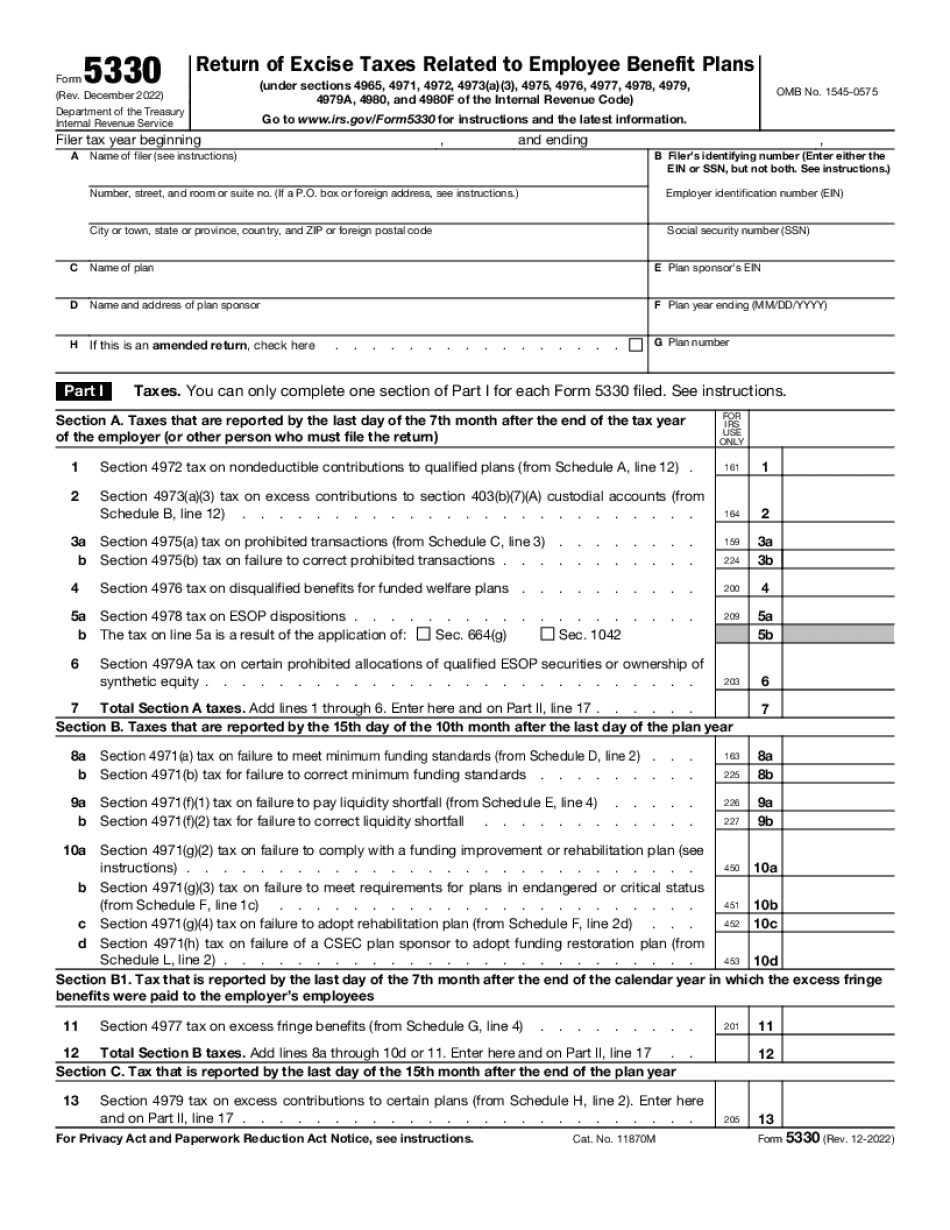

How to complete a Form 5330 online Arvada Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5330 online Arvada Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5330 online Arvada Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.