Award-winning PDF software

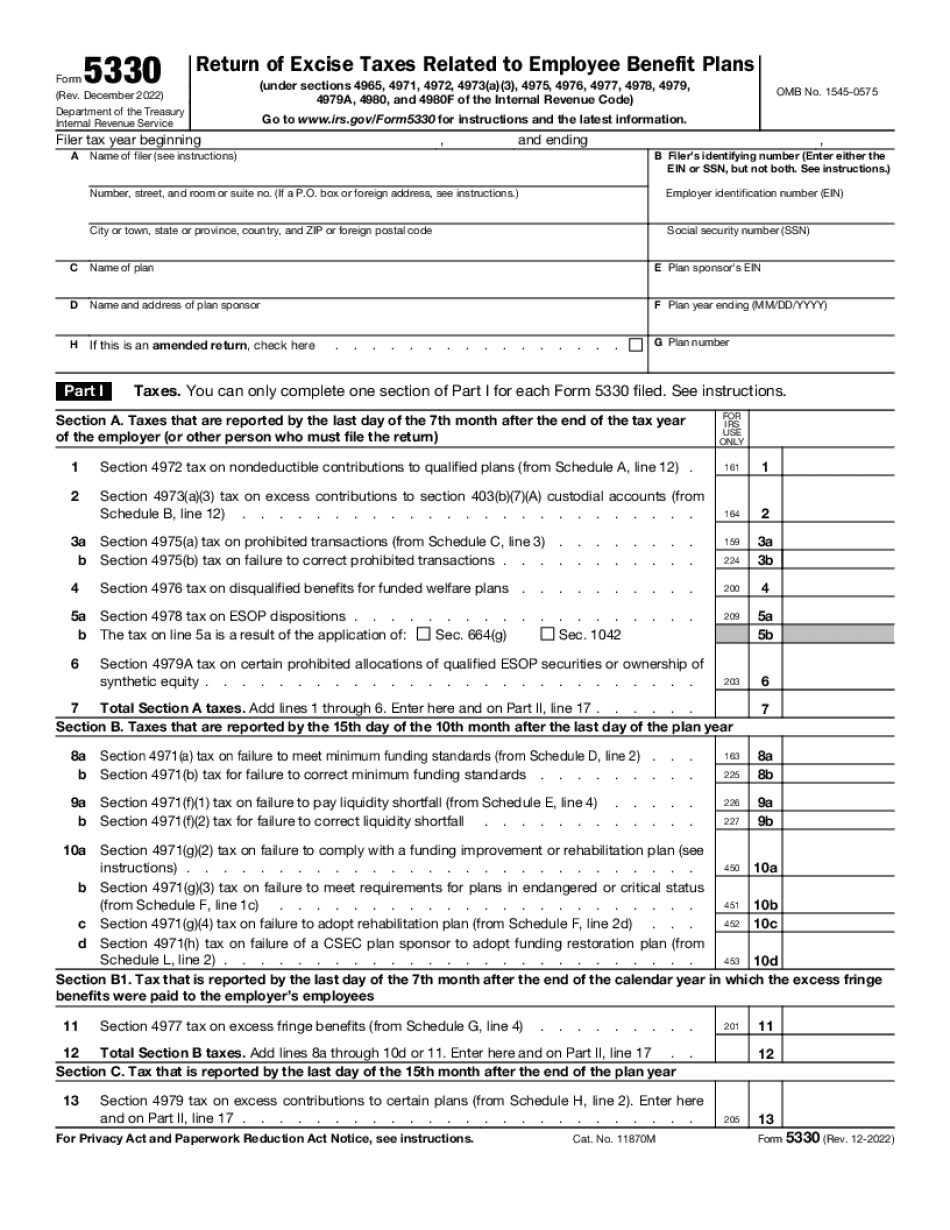

Nampa Idaho Form 5330: What You Should Know

The City makes a commitment to all its citizens to be responsible citizens and to pay only a portion of their income. It is the City's policy for all city employees, including employees in the city's Police Department, Fire Department, and Emergency Management, to submit only a portion of their wages to the City. To avoid the possibility of a tax refund and to protect the City from loss of taxes, it is the policy of The City of Nampa to withhold 10 percent of employees' wages (plus the city's share of income taxes) and remit it to all states and any other taxing agency for payment of taxes on state income tax returns. All City employees must report and pay the “Municipal Wage Deduction” to the city, as detailed in the Idaho Code (IC) 11-1301 through IC 11-1310. All employees of the Police Department and Fire Department of The City of Nampa are required to complete a sworn statement concerning the City's policy for withholding and remitting taxes. This sworn statement needs to be signed by an agent of the City of Nampa who is familiar with the specific facts and circumstances of the situation to determine if the individual employed by the City should be withholding and remitting tax. [1] An employee paid less than the minimum allowed by law must provide an explanation. [1] The City of Nampa requires every employee to receive a certified copy of the City's annual city budget and financial report. (This can be obtained by clicking here or by clicking the link provided at the top of the page) City of Nampa's 2 Annual City Budget and Financial Report The City of Nampa's budget does not include the amount of state income tax a city employee is expected to withhold and remit to all other states. City of Nampa's Tax Department operates only from revenues generated by the City. The City uses tax dollars only to help finance its services and programs. The tax department does not take any funds generated by the city from the sale of property; it does not accept contributions from property owners for capital improvements; nor does it take any funds raised from sales for purposes other than the operation and maintenance of the tax administration. The City of Nampa's City Manager reserves the right to change or eliminate any tax, fee, assessment, or other charge imposed by the city or passed by the community.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Nampa Idaho Form 5330, keep away from glitches and furnish it inside a timely method:

How to complete a Nampa Idaho Form 5330?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Nampa Idaho Form 5330 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Nampa Idaho Form 5330 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.