Award-winning PDF software

Printable Form 5330 Sunnyvale California: What You Should Know

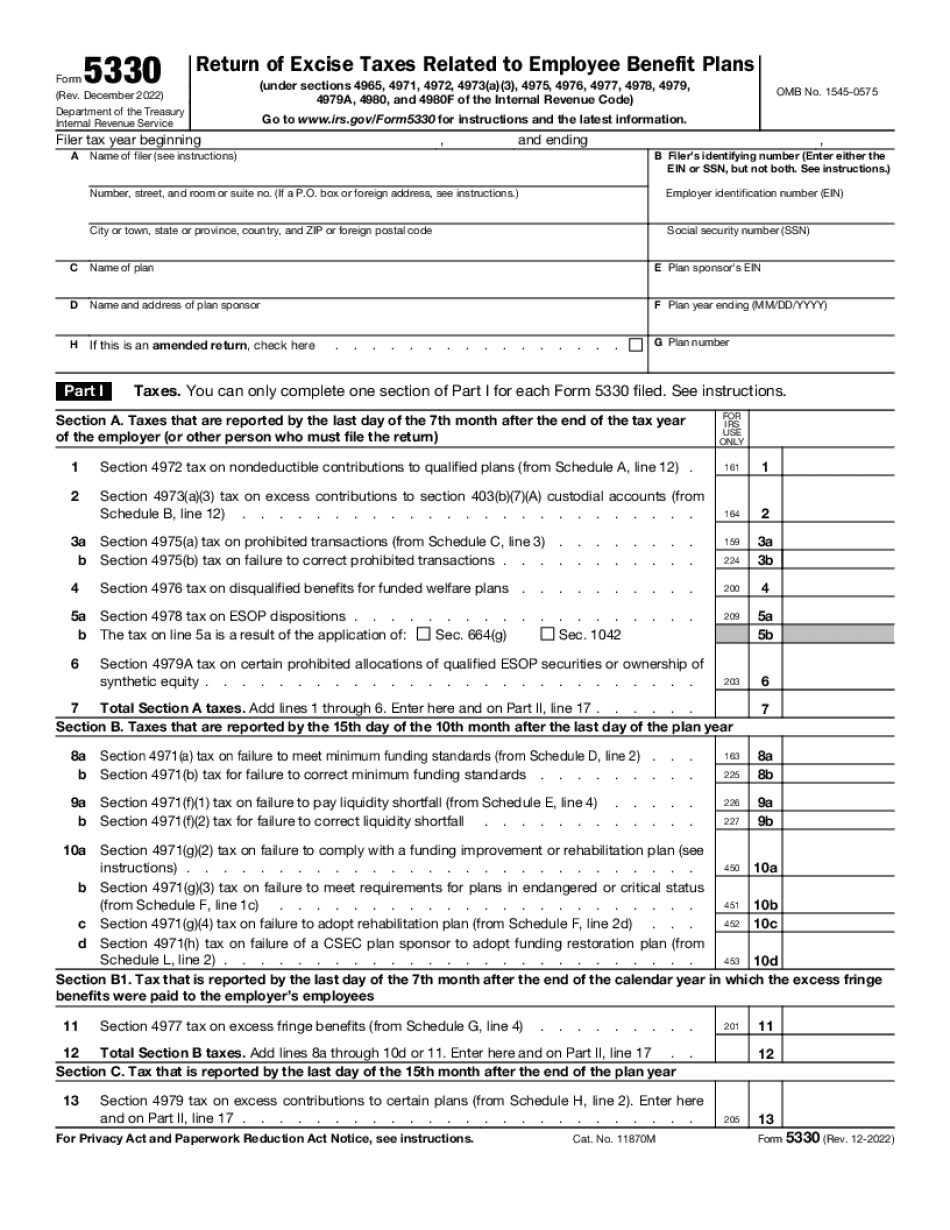

Filing Form 5330 for San Francisco, CA — Fill exactly for your city. Filing Form 5330 for San Francisco, CA — Fill the blank. Filing form 5330 for San Francisco, CA — Fill the blank. Filing Form 5330 for San Jose California Filing Form 5330 for San Jose California. Filing Form 5330 for San Jose California. The Form 5330 tax form allows employees to collect or pay taxes related to their pension and retirement plans. The tax form has two pages—the second page presents the employer and the employee, the next page contains three questions you have to answer and a return to send to the tax office that you sign (unless you also sign a form to indicate that you received notice about an issue with your tax form. For the tax form, there is an additional form. Form 5317A is used for employees who are employed with the same company for a long period of time (less than 40 workweeks) as opposed to for current employees who switch employers every few years. This additional form is not required unless the employee also makes a claim for unemployment. The tax form is filed electronically with the IRS at the IRS website. Form 5330 — Payment Due Date & Tax Rates The filing of Form 5330 is done on a monthly basis using Form 5330 — Filing and Refund Due Date. You can submit your taxes when filing your check through the online payment option in either of the following ways: The first line asks you to select a tax year when the last day (the 3rd Friday of the month if January, February and March, and the 4th Friday of the month in July–August) is to be entered in the last column of the table. If you use this online check-payment option to pay by check, all you have to do is pick the tax year (April 1 to March 31) that corresponds to the first day of the month you want to file your taxes. (For example: April 1, 2010, to May 31, 2010. There should be some blank space before the last date listed, which is also the date tax is due. For example: April 1, 2010, to May 31, 2010) Once you've chosen a tax year to file your taxes, the table lists the current tax rates, along with a range of interest rates. In the next column of the table, there is a column called “Payment Due Date (YTD)”.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5330 Sunnyvale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5330 Sunnyvale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5330 Sunnyvale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5330 Sunnyvale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.