Award-winning PDF software

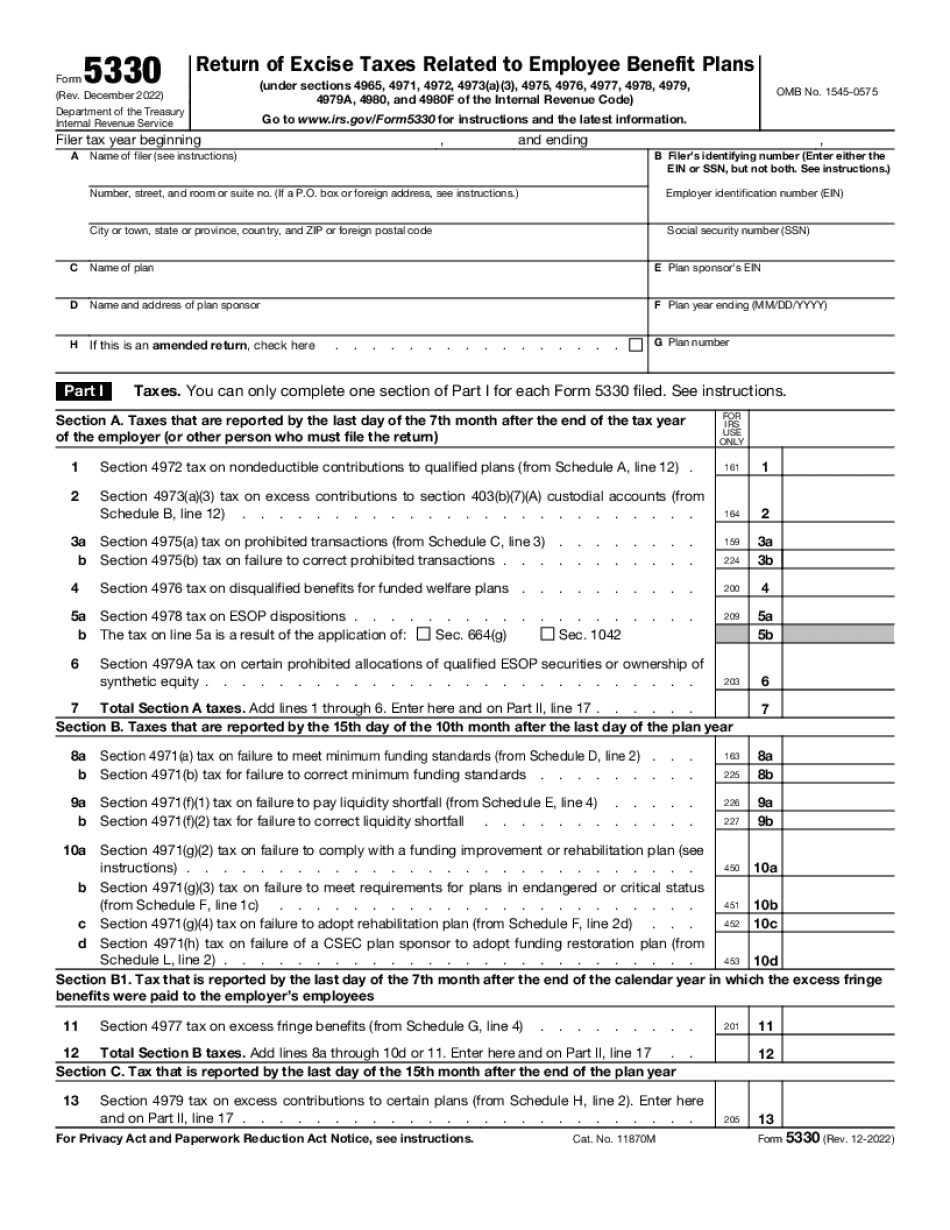

Form 5330 for Detroit Michigan: What You Should Know

These taxes are taxes that apply to employee remittances. Because they're excise taxes, the Form 5330 is filed and filed with each of the plan documents as well as with the annual tax return. These are your tax return filing responsibilities for these taxes: Qualified Retirement Plan and 403(b) Plan Taxes — Form 5307, 5802, 6011, or 6012 (only a copy is required) 403(b) Plans — Form 5405, 5406, 5510, or 5519 (only a copy of the Form 5405 is required if the employee was employed at least half the year, and the employee received no other compensation from the employer and did not participate in a retirement plan or a private endowment described in the code section or paragraph of this summary). If you have a 403(b) plan, report all of your compensation in this income in the year you receive it. If you don't receive compensation from the employer, you can get a Form 5405 from the IRS. You don't need to file Form 5405. The Form 5308 that appears on forms that the employer sends you does not have to be filed with the Form 5404 and Form 5405 that appears on the Form 5330. The Form 5308 simply tells you how much additional money you can invest and receive tax-free on this money. This is the only tax that is deducted from each payment that an employee makes to a qualified retirement plan or 403(b) plan. 401(k) Plans — Forms 5203, 5205, 6216, or 6217 (only a copy of the completed Form 5203 or any of the Forms listed above is required if no income is received from the plan and the plan are a plan that is neither self-employment nor a defined contribution plan that is not operated for profit as shown on Form 8959 (or on any schedule that is attached to your Form 8959). If you don't have income from the plan, a copy of your Form 5207 (if any) is required. The Form 5910 or 5915 has to be attached to your tax return. The Form 2948 doesn't have to be attached to your tax return either, but be aware of it. You need only a copy of the completed Form 956 or 959 to report this amount. The Form 5308 only applies to plan compensation that isn't from employee remittances (e.g.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 5330 for Detroit Michigan, keep away from glitches and furnish it inside a timely method:

How to complete a Form 5330 for Detroit Michigan?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 5330 for Detroit Michigan aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 5330 for Detroit Michigan from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.