Good morning, everyone. This is Mad City CPA, and I am doing a quick video about the changes in retirement plan treatments by the tax reform for 2019 filers for the tax year 2018. I am referring to the IRS Publication 5307, which covers the tax reform basics for individuals and families. Specifically, I am making a video focusing on retirement plans and education. I personally love both aspects. Now, let's dive into the details. One major change is that you can no longer recharacterize a conversion from a traditional SEP or simple IRA to a Roth IRA. This was a popular practice in the past, but now it is prohibited. However, you can still make a regular contribution to either an IRA or a traditional IRA and consider it made to the other. Another important point to note is regarding plan loans to employees who leave employment. If you terminate your employment and have an outstanding plan loan, the plan sponsor may offset your account balance with the outstanding loan balance. If a plan loan is offset, you have until the due date, including extensions, to rollover the loan balance to an IRA or an eligible retirement plan. This is something to consider if you leave employment with an outstanding plan loan. Now, let's talk about disaster relief for retirement plans. Laws enacted in 2017 and 2018 have made it easier for retirement plan participants to access their funds in the event of disaster losses incurred in federally declared disaster areas in 2016, 2017, and 2018. These relief measures include waiving the 10% additional tax on early distributions, allowing qualified hurricane distributions to be included in income over a three-year period, and providing options to repay the distributions to the plan. Loan availability has also been expanded, and the loan...

Award-winning PDF software

Publication 5307 Form: What You Should Know

Here, we will explore its key How Payroll Taxes Work in Every State One of the most common questions we get is, “How do I know how much Social Security I need to pay?” In this blog post, we provide answers to those questions and provide suggestions for what you can do to help your employees pay their taxes.

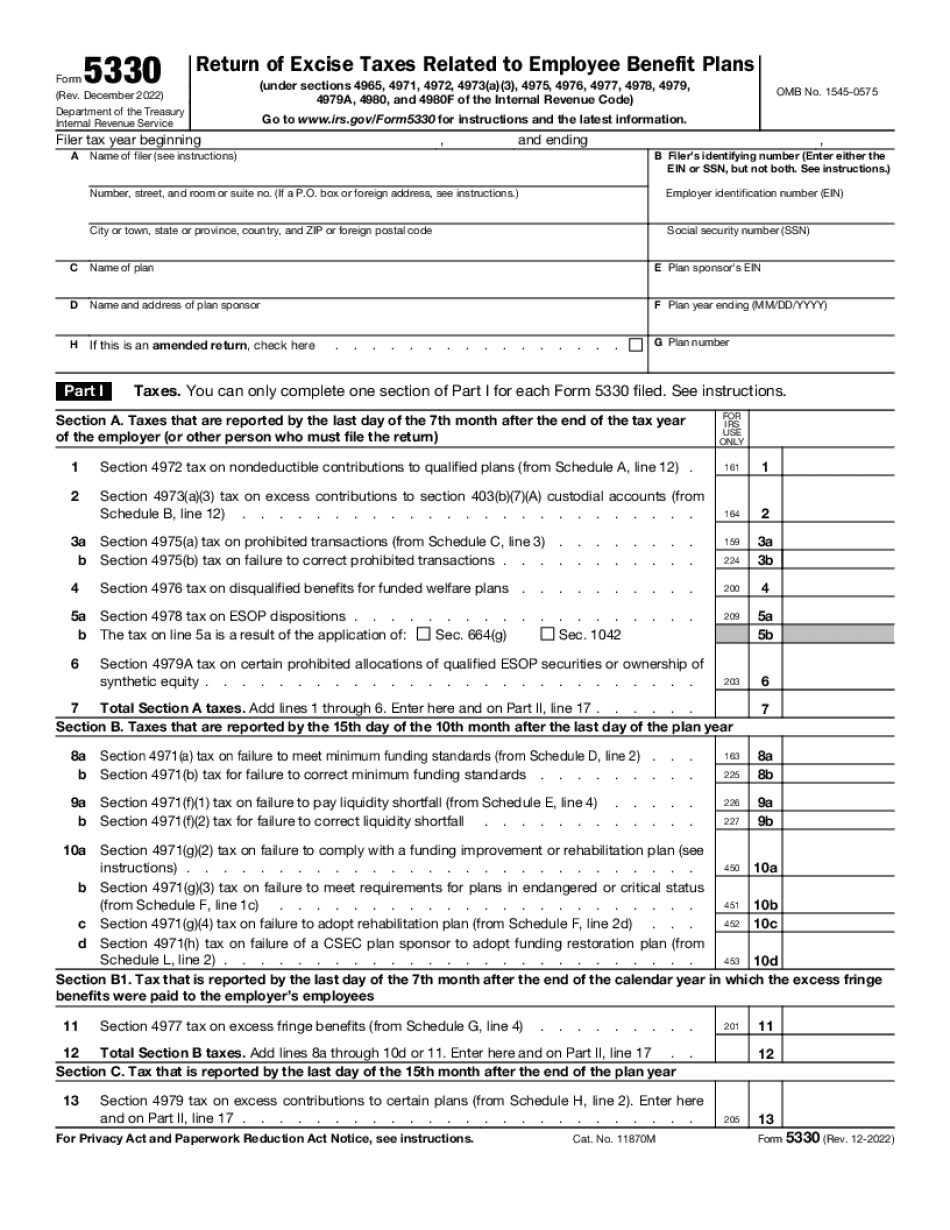

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5330, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5330 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5330 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5330 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Publication 5307