A Tax Cuts and Jobs Act, as amended, was passed by Congress last year. They enacted the biggest tax overhaul in a generation by making modest tax cuts for the middle class and slashing corporate tax rates. President Trump stated that the overhaul would bring significant economic benefits to the country. Now that Americans are filing their tax returns for the first time under the new law, how will they actually see the changes? Here's what it means for your personal finances in four minutes or less: Under the new law, 80% of Americans are expected to pay fewer taxes in 2018, according to the Tax Policy Center. This means many Americans will have more money in their paychecks. However, many filers will see smaller refunds compared to the previous year. In fact, IRS data shows that total tax amounts refunded are down from tax year 2017. Personal finance expert Lynette Calif Ani Cox explains why this is the case in 2018. The big change that occurred is that the withholding tables changed, resulting in less taxes being taken out of most people's paychecks. This means they had bigger paychecks, but the difference was relatively small, for example, around $20 or $50 per pay period. As a result, it wasn't particularly noticeable. When people heard about getting a tax break, they thought their tax refund checks would increase. However, this is not how it works. The reality is that fewer taxes were taken out of their paycheck throughout the year, effectively reducing the refund they receive. Getting less of a refund is actually a good thing. If you receive a refund, it means you paid too much in taxes over the course of the year, providing the government with a zero interest loan. This is not a wise financial move. It is much...

Award-winning PDF software

Publication 5330 the new tax cut law will impact your 2022-2025 tax return Form: What You Should Know

The income method of accounting is now used.

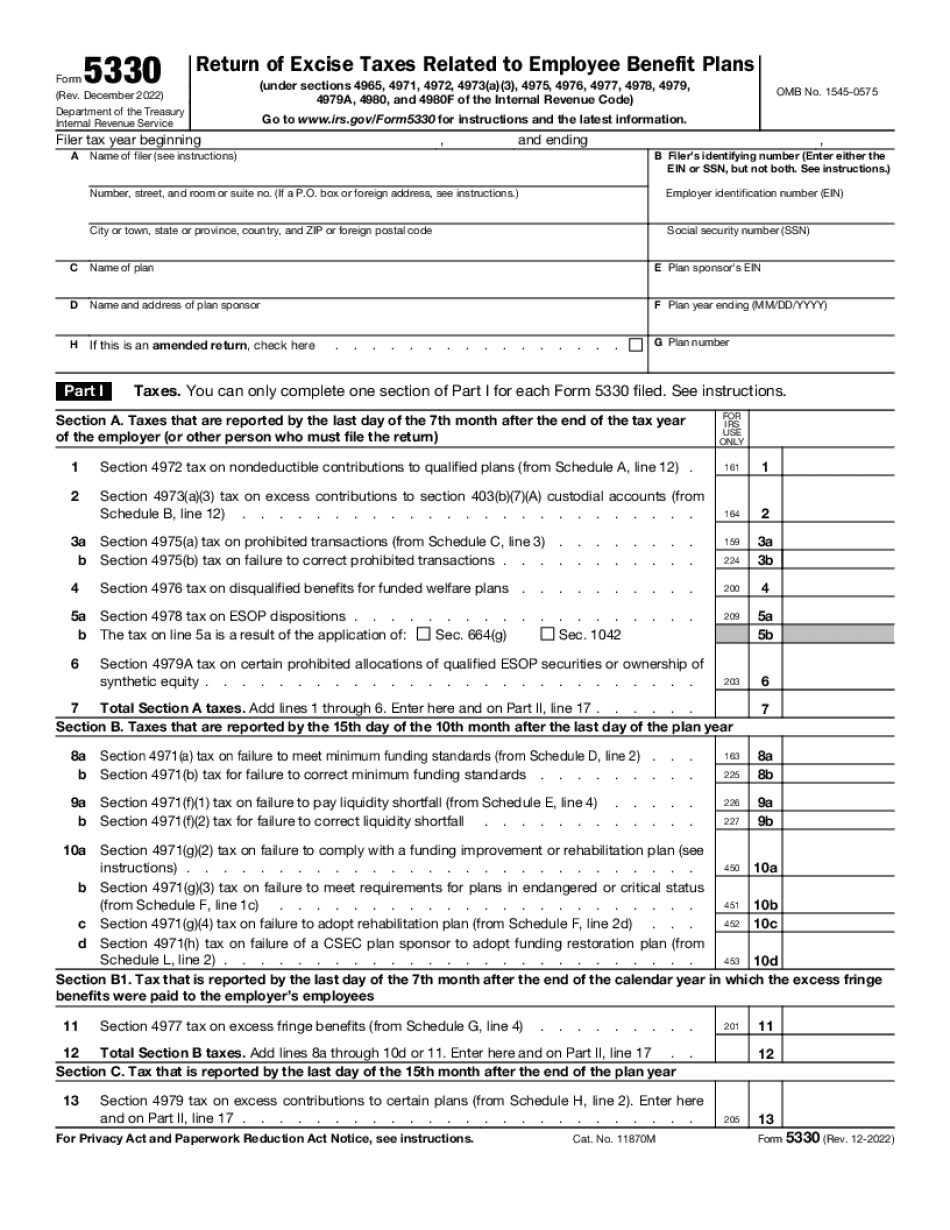

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5330, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5330 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5330 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5330 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Publication 5330 the new tax cut law will impact your 2022-2025 tax return