Award-winning PDF software

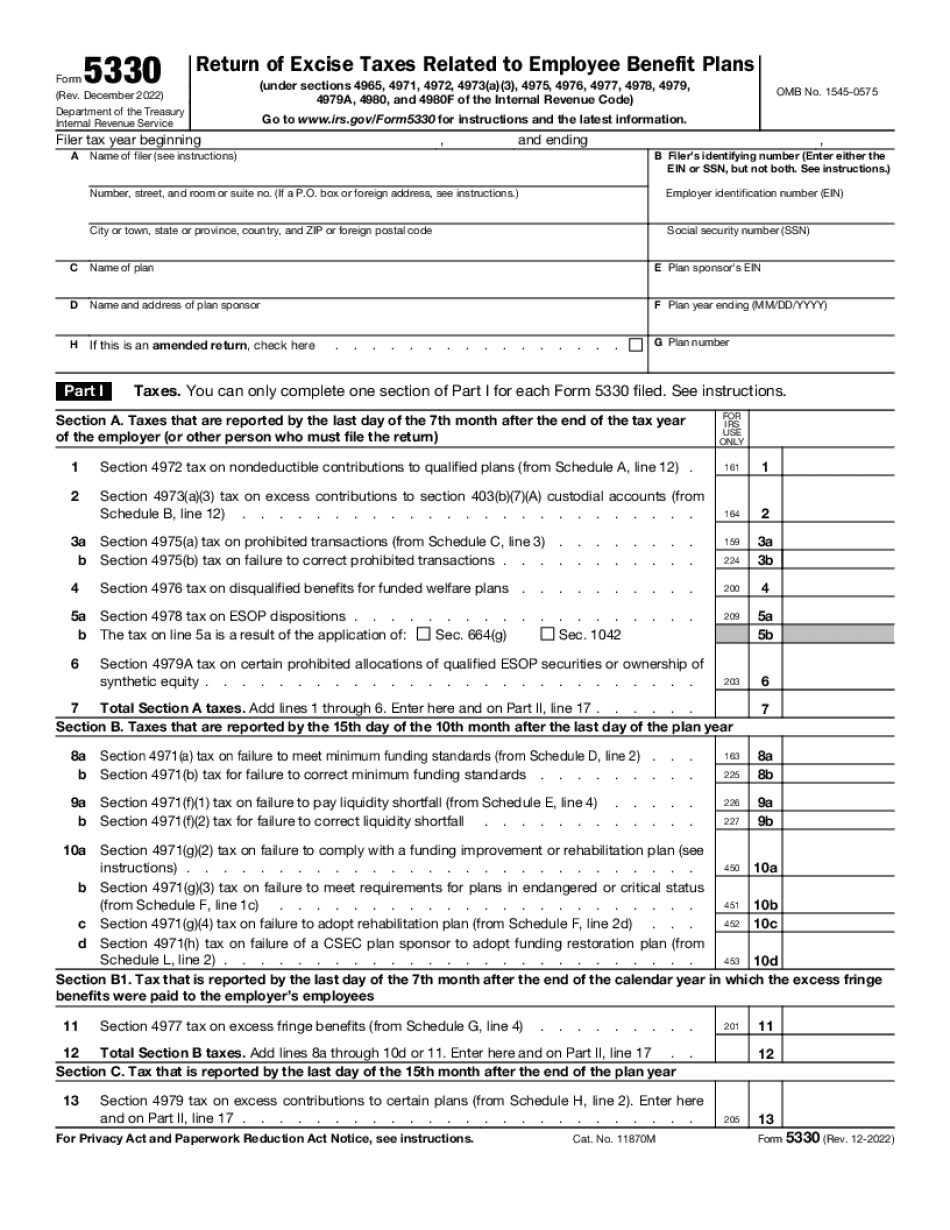

2022-2025 5330 Form: What You Should Know

IRS Adds Form 5330 Instructions for 2025 and Later Year Years — FuturePlan April 22, 2025 — The 2025 version of Form 5330 appears in the Resources section of the IRS website, as an attachment to Publication 597, Tax Guide for Business. (PDF). Get PDF of 2025 Form 5. Read IRS 2025 Form 5 | DWC This form is used when a non-exempt individual contributes to a 401(k) plan and later receives payments from a qualified retirement plan. It is required for employees and shareholders in the United States, the District of Columbia, the Commonwealth of Puerto Rico, the United States Virgin Islands and Guam, and certain other U.S. territories and possessions as well as international organizations. A non-exempt individual may contribute to qualified retirement plans as a member of an organization with qualified immunity. IRS Adds 2025 Form 5 for Employees, Employees' Shareholders and Employer — FuturePlan Nov 6, 2025 — The 2025 edition of the 2025 Instructions for Form 5330 appears in the Resources section of the IRS website, as an attachment to Publication 599, Tax Guide for Individuals. Read PDF of 2025 Form 5. Get PDF of 2025 Form 5. Read 2025 Form 5. IRS Adds Form 5 to Exempt Organizations With Qualified Inherent Insolvency — FuturePlan June 23, 2025 — The 2025 edition of the Instructions for Form 5330 appears in the Resources section of the IRS website, as an attachment to Publication 599, Tax Guide for Individuals. Read 2025 Form 5. IRS Adds 2025 Form 5 for Exempt Organization With Qualified Insolvency — FuturePlan June 11, 2025 — The 2025 edition of the Instructions for Form 5330 appears in the Resources section of the IRS website, as an attachment to Publication 599, Tax Guide for Individuals. Read 2025 Form 5. IRS Adds 2025 Form 5 for Exempt Organization With Qualified Insolvency — FuturePlan June 3, 2025 — The 2025 version of the Instructions for Form 5330 appears in the Resources section of the IRS website, as an attachment to Publication 599, Tax Guide for Individuals. Read 2025 Form 5.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5330, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5330 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5330 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5330 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.